Albert Bourla Net Worth - Mastering Your Money Life

Many people, you know, find themselves wondering about the financial standing of prominent figures, like when someone searches for "Albert Bourla net worth." It's almost as if there's a natural curiosity about how wealth is gathered and, perhaps more interestingly, how it's managed. That kind of interest, in a way, often comes from a place of wanting to understand the bigger picture of financial success, or maybe just a little bit of curiosity about the lives of those who stand out. It’s a pretty common thing, actually, to look at someone's financial journey and consider what lessons it might hold for your own money path.

But, you see, whether we're talking about someone with a very significant fortune or just someone starting their financial adventure, the fundamental principles of handling money effectively remain surprisingly similar. It’s really about having a clear picture of what's coming in and what's going out, making smart choices about where your money goes, and preparing for what might come next. In fact, for anyone hoping to take charge of their economic situation, having the right tools and a solid approach can make all the difference, truly.

And that's where modern solutions come into play, offering a straightforward way to get a grip on your money. Imagine having a helpful guide right there with you, making the whole process less complicated and, frankly, more approachable. One such helper, a financial companion that millions are already finding useful, aims to put that kind of power right into your hands. It’s all about giving you the ability to shape your own financial story, no matter what your starting point looks like.

- Flip Wilson Comedian

- Twitter Adriana Chechik

- Long Hair Aaron Rodgers

- Adriana Chechick Twitter

- Is Donald Faison Gay

Table of Contents

- Exploring Personal Finance Journeys

- How Does 'Albert Bourla Net Worth' Relate to Everyday Money Management?

- Taking the Reins of Your Money Life

- Can an App Really Help with 'Albert Bourla Net Worth' Level Financial Planning?

- Getting Started with Your Financial Companion

- What Happens After You Join Albert – Is 'Albert Bourla Net Worth' a Goal?

- Smart Features for Smart Savings

- Could 'Albert Bourla Net Worth' Benefit from Automated Savings?

Exploring Personal Finance Journeys

People often get curious about the wealth of well-known figures, like when they look up "Albert Bourla net worth," and that curiosity, you know, sometimes sparks a broader interest in how people manage their money. It's almost as if seeing someone else's financial standing makes us think about our own. We tend to wonder about the paths others take to build up their resources, and perhaps, what kind of strategies they use to keep things in order. This kind of interest is pretty natural, as a matter of fact, because everyone, in some way, wants to feel secure about their own financial standing.

The truth is, managing money, whether you have a little or a lot, involves some pretty similar steps. It's about making choices that serve your goals, keeping track of where your funds are going, and making sure you're ready for what life throws your way. You know, it's not just about the size of the bank account; it's about the habits and tools you use. For instance, someone with a substantial amount of money still needs to budget, save, and think about where their resources are best put to use. It’s basically about having a clear picture and a solid plan, which is something everyone can benefit from, really.

So, while the specifics might vary, the core ideas of sound money handling apply to just about everyone. It’s like, no matter how much you have, you still need to know what your financial picture looks like. You still need to make sure your money is working for you, and that you're not missing opportunities to grow it or protect it. That, in essence, is what personal finance is all about: getting a handle on your money life so you can feel more in control and, you know, more confident about your future. It’s a journey, actually, that everyone can take, regardless of their starting point.

- Tracey Mcshane

- Blake Anderson Girlfriend

- Bocil Meaning In Indonesia

- Simp Means

- Is Anderson Cooper A Lawyer

How Does 'Albert Bourla Net Worth' Relate to Everyday Money Management?

When folks inquire about something like "Albert Bourla net worth," it really brings up a bigger conversation about how financial well-being is achieved and maintained, no matter the scale. It's almost like, even if someone has a very large sum of money, they still face decisions about spending, saving, and investing. The principles that help a regular person manage their paycheck are, in some respects, the same ones that guide someone handling a fortune. It’s all about making informed choices and having a system in place. For example, knowing where your money goes is just as important for someone with a high income as it is for someone on a tighter budget, you know?

Consider this: a person looking to improve their daily finances needs to budget, save for goals, and perhaps put some money aside for the future. Similarly, someone with significant assets also needs to allocate their resources wisely, protect what they have, and plan for long-term growth. The tools might look different, but the core actions are surprisingly alike. It’s basically about making your money work for you, rather than just letting it sit there or disappear without a trace. That, in a way, is a universal truth about money.

And that's where a powerful financial companion, one that helps you manage your money, can be incredibly useful. It offers a way to bring those core financial principles to life for anyone. It's like having a personal assistant for your money, helping you see the whole picture and make smart moves. This kind of help is something that could, arguably, benefit anyone, from those just starting out to those who have already built up substantial resources. It's about making financial management accessible and, frankly, a lot less intimidating for everyone, which is pretty neat.

Taking the Reins of Your Money Life

Taking charge of your finances with a helpful app means you get to really steer your own money ship. It’s not just about watching what happens; it’s about making things happen. You know, when you have a clear view of your money, you can make choices that truly serve your personal goals. This kind of control can feel incredibly empowering, giving you a sense of calm about your financial future. It's almost like having a clear map for your money, showing you where you are and where you're headed. That, in some respects, makes the whole process a lot less stressful and a bit more exciting, too.

Imagine having a single spot where you can budget your funds, put money aside for future needs, keep an eye on your everyday spending, and even put some resources into growth opportunities. This comprehensive approach means you're not juggling multiple tools or trying to piece together different bits of information. It’s all there, in one incredibly powerful application, making it simpler to manage your entire financial picture. This kind of centralized control is, basically, a huge step towards feeling more secure about your money, which is really what everyone wants, isn't it?

And it's not just a theoretical idea; millions of people are already finding this kind of integrated financial management genuinely helpful. You know, over 10 million individuals are using this very tool today to make sense of their money and work towards their financial aspirations. That, in itself, speaks volumes about how effective and approachable this kind of support can be. It’s like joining a large community of people who are all committed to making smart money moves, which is pretty encouraging, actually.

Can an App Really Help with 'Albert Bourla Net Worth' Level Financial Planning?

The idea of an app helping with financial planning that might seem relevant to someone with "Albert Bourla net worth" level resources might sound a little surprising at first, you know? But the truth is, the fundamental acts of managing money—budgeting, saving, spending wisely, and investing—are universal. Whether you're managing a modest income or a very substantial amount of money, these core activities remain crucial. An app, in essence, provides the framework and the tools to perform these actions efficiently, regardless of the dollar figures involved. It's almost like, the bigger the financial picture, the more you need a clear system, and that’s where a well-designed app can truly shine.

Think about it: the ability to budget your funds with precision, put money aside for specific aims, keep a close watch on your outgoings, and even explore avenues for growth, all from one spot, offers a kind of clarity that's valuable at any level of wealth. This integrated approach means you're not just reacting to your money; you're actively shaping its direction. It’s about being proactive, which is, in some respects, a key to financial success for everyone. The power of having everything together in one incredibly capable application means less guesswork and more informed decisions, which is pretty important, actually.

The fact that over 10 million people are currently using this kind of comprehensive financial companion today really shows its broad appeal. It’s not just for one type of person; it’s for anyone who wants to feel more in command of their financial life. This widespread adoption suggests that the core functions — budgeting, saving, spending, and investing — are genuinely helpful across a wide range of financial situations. So, while the scale might differ, the need for smart money management tools is, basically, a shared human experience, you know?

Getting Started with Your Financial Companion

Getting started with your own financial companion is, honestly, a pretty straightforward process. It’s designed to be simple, so you can begin taking control of your money life without a lot of fuss. The very first step is to bring the application onto your mobile device. You just head over to your phone's app store, search for the name, and download it. It’s almost like getting any other helpful tool for your phone, which makes it very familiar and easy to do, you know?

Once the app is on your phone, you just open it up to begin the registration process. This part is also quite simple: you’ll be asked to provide your name, an email address, and then you'll choose a secure password. That password is, basically, your key to keeping your financial information safe within the app. It’s a quick series of steps that sets you up to start exploring all the helpful features inside. That, in a way, is all it takes to open the door to a more organized financial picture.

This initial setup is really about creating your personal space within the app, a place where you can begin to gather all your financial information. It’s designed to be user-friendly, ensuring that anyone can get going without feeling overwhelmed. So, you know, just a few taps and some basic information, and you’re ready to move on to the next step of really getting your finances in order. It's pretty cool how accessible it all is, actually.

What Happens After You Join Albert – Is 'Albert Bourla Net Worth' a Goal?

After you’ve set up your account with your email address and chosen a password, the next step is where the real magic of understanding your financial picture begins. You connect your existing financial accounts to the app. This means bringing together information from your bank accounts, credit cards, and perhaps other places where your money resides. It’s almost like gathering all the pieces of a puzzle so you can see the complete image of your money situation. This comprehensive view is, basically, what allows the app to truly help you.

Once all your accounts are linked, the app then looks at your entire financial picture. It’s not just seeing one part; it’s taking in everything – your income, your outgoings, your savings, and your debts. This holistic view is what allows the app to provide genuinely useful recommendations. It’s like having a smart assistant that can see all the connections and patterns in your money life, offering suggestions that are tailored to your unique situation. This kind of insight is, arguably, invaluable for anyone trying to get a better handle on their money, regardless of their current financial standing or if their goal is to reach something like "Albert Bourla net worth."

The idea here is to move beyond just tracking individual transactions and to really understand the flow of your money. By seeing everything together, the app can spot opportunities for saving, suggest areas where you might be able to adjust your spending, or even highlight ways to put your money to better use. It’s basically about giving you the clarity you need to make smarter financial choices. This comprehensive overview is, truly, a powerful starting point for anyone looking to optimize their money life, which is pretty cool, actually.

Smart Features for Smart Savings

One of the really useful aspects of this financial companion is its ability to help you with instant access to funds when you need it. To get started with these kinds of advances, you simply head to the main screen in the app or access it online. You’ll see an option there, usually labeled "instant," and you just tap on it. Then, you follow the simple prompts to set things up. It’s designed to be a quick and easy way to get a little extra help when unexpected expenses pop up, which is pretty convenient, actually.

Beyond those immediate needs, the app truly helps you budget and keep track of your spending with remarkable clarity. You can monitor your bills, watch your cash flow, and see exactly where every single dollar is going. This kind of detailed insight means no more guessing about your money. It’s like having a magnifying glass on your financial habits, showing you precisely what’s happening with your funds. That, in a way, gives you the power to make informed decisions about your daily spending and long-term financial health.

A particularly smart feature is called "smart money." When you turn this on, the app really gets to work analyzing your income and your spending patterns. It looks for small amounts of money that it believes you can comfortably put aside for saving and even for investing each week. This isn't about taking huge chunks; it's about finding those little bits that add up over time without you really feeling the pinch. You can expect this "smart money" feature to genuinely help you build up your savings steadily and almost effortlessly, which is pretty neat.

Furthermore, the app gives you the chance to open a high-yield savings account. This means you can earn competitive rates on the money you deposit, rates that are often significantly higher than what traditional banks offer. We’re talking about rates that are, you know, over nine times the national average, which is a pretty substantial difference. This kind of account allows your money to grow more quickly just by sitting there, which is a very good thing, really.

And to make saving even easier, you can set it up to save automatically based on your income and how you spend. This means you’re not relying on willpower; the app does the work for you. You earn that annual percentage yield with the high-yield savings, and you can also create custom savings goals. So, whether you’re saving for a new car, a down payment on a home, or just a rainy day fund, you can set a specific goal and watch your progress. It’s basically about making saving a consistent and rewarding part of your financial routine, which is pretty powerful, actually.

Could 'Albert Bourla Net Worth' Benefit from Automated Savings?

When considering someone with a significant financial standing, like what might be implied by "Albert Bourla net worth," you might wonder if automated savings features would still be relevant. The truth is, the discipline of setting money aside consistently, even automatically, is a principle that benefits everyone, regardless of how much money they have. It’s almost like, even with vast resources, the habit of structured saving ensures that wealth is not just accumulated but also preserved and grown thoughtfully. It removes the human element of forgetting or procrastinating, which is pretty valuable, you know?

Automated savings, in essence, establish a consistent rhythm for wealth accumulation. For someone managing a large portfolio, this might mean regularly allocating funds to specific investment vehicles or long-term growth accounts without having to manually initiate each transfer. It’s about creating a steady flow of resources towards predetermined financial goals, whether those are for future projects, charitable giving, or simply expanding their overall financial base. That, in a way, streamlines the process of wealth management and makes it more efficient, which is really important for substantial assets.

Moreover, the concept of earning competitive rates on deposits, even on large sums, through something like a high-yield savings account, is universally appealing. More interest means more growth, period. And the ability to set custom savings goals, even for very large sums or specific ventures, provides a clear framework for financial planning. So, basically, while the scale of the numbers might be different, the benefits of automated, high-yield savings and goal-oriented financial planning are, arguably, just as relevant and useful for someone with significant wealth as they are for anyone else. It’s about smart money habits, which are pretty universal, actually.

- University Of Arizona Global Campus Accreditation

- Lauren Graham Husband

- Celine Dion Dead

- How Was Cynthia Erivo Involved In The Greatest Showman

- When Is The Chicken Chalupa Coming Back 2024

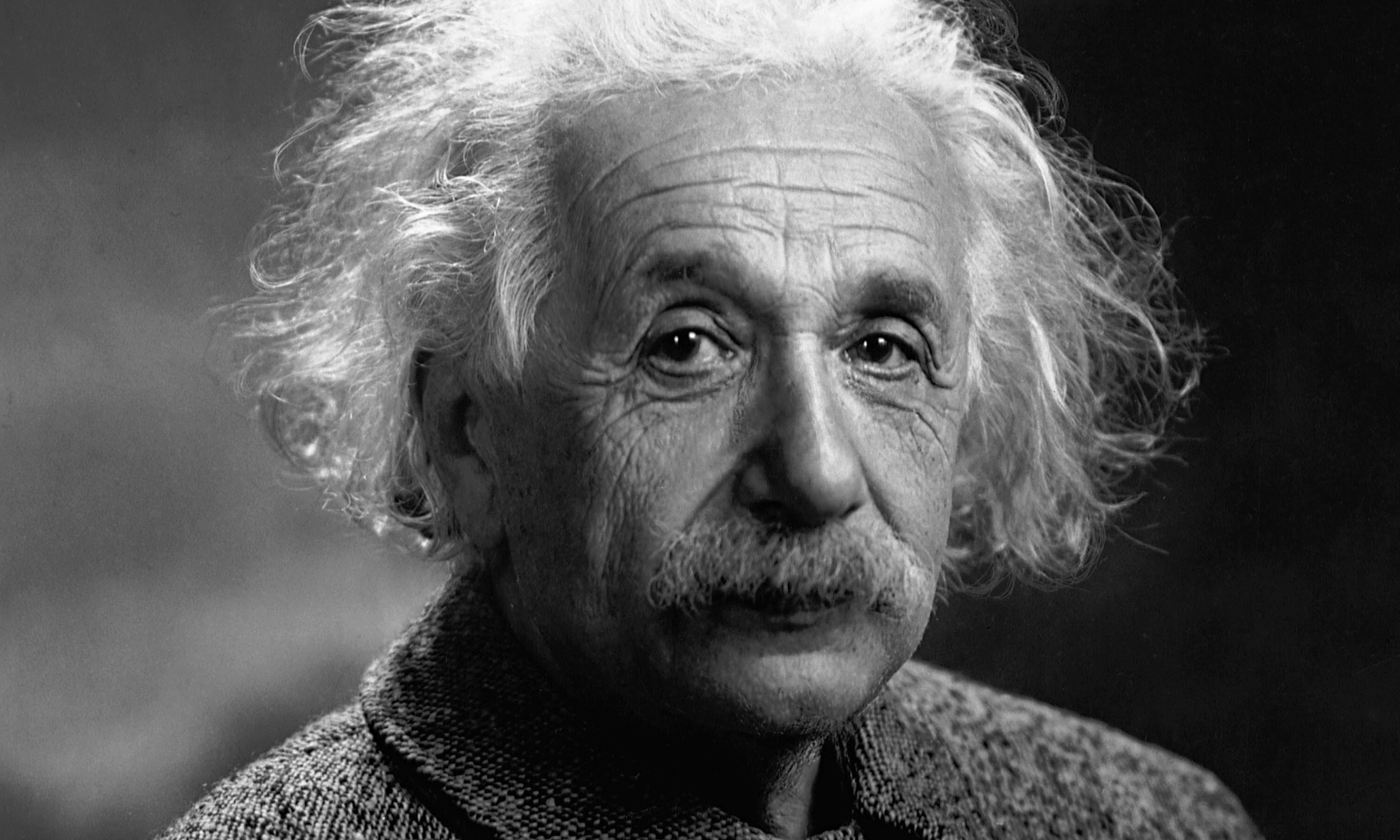

Albert Einstein Wallpapers Images Photos Pictures Backgrounds

Albert Einstein Birthday

Albert Einstein | Biography, Education, Discoveries, & Facts | Britannica